From time to time I keep hearing business owners ask: how come my competitor managed to increase their client base a few times faster than me, even despite having a very similar offering? Of course, there might be at least several reasons for such a dynamic growth, but more often than not the secret lies in making well-calculated investments focused around marketing and sales processes. Lifetime Value (LTV) is the factor that can help you prepare such an effective strategy. In a nutshell:

Lifetime Value determines how much money you can expect from a single customer throughout their entire lifespan at your company.

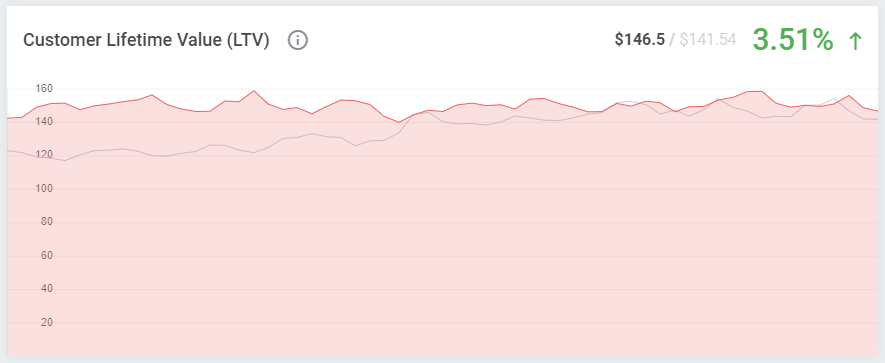

In this example, it is estimated that one user will spend around $146 with your brand before they decide to quit.

In this example, it is estimated that one user will spend around $146 with your brand before they decide to quit.

Doesn’t seem like a huge helper? At a first glance – maybe, but once you explore these numbers further, it turns out that LTV gives you a pretty in-depth analysis of your company, and power to make significant business decisions such as increasing marketing budget, upgrading the customer service or improving your pricing model.

LTV and marketing strategy

LTV is often used to determine if allocating more money into acquiring a new user is worth the effort. In other words, the higher the LTV, the more you can allow yourself to spend on attracting new users. The easiest way to calculate the profitability of this strategy is to match it against the Customer Acquisition Cost (CAC). If the cost of acquiring a single user (CAC) is higher than the amount of money a user will leave in your company (LTV), you are not getting much of a bargain out of it, are you? On the other hand, if the acquisition cost is much lower than the LTV value, you may go wild with your marketing tactics as in the long run this investment will definitely pay off!

What affects LTV?

LTV is usually a steady metric that over a short period doesn’t fluctuate much and stays at a similar level most of the time. Therefore, for any visible changes to take place, you must shift into a long-term mindset, and even then your LTV rate may not shoot up as quickly as you’d like. As Leo Tolstoy once put it, “The two most powerful warriors are patience and time”.

But first things first, let’s take a closer look at the formula behind LTV:

LTV = ARPU (Average Revenue Per User) / Churn Rate

When is LTV increasing then?

Basing on the above calculation, we may safely assume that the LTV rate is moving upwards when:

- You keep improving your services so that more and more customers are staying with you for longer. Simply put, when you manage to maintain your churn (subscription cancellations) at the lowest level possible.

- Your ARPU is rising. But in order to achieve that, you need to introduce several key adjustments to your business model first. In case you may want to start right away, I have listed a few tried-and-tested tricks in one of my previous articles. Feel welcome to consult it any time!

Why is my LTV declining?

This is one of those more unpleasant scenarios and it may mean that:

- Your churn is too high and customers are abandoning your services way too often. This can be caused by at least a couple of factors that I made sure to include in my latest Blog post on churn.

- Your clients are not spending as much money on your services on a monthly basis as they used to.

I think we can all agree that ARPU and churn are two most decisive metrics when it comes to stepping your LTV up, and creating for your company healthy conditions to grow. Monitoring the LTV level over an extensive period of time will help you plan effective marketing campaigns that can make a name for your business on this tight, competitive web hosting market.

Building your base of loyal customers should start from the awareness though, so make sure that you have a robust and detailed reporting tool that you can always rely on! And should you look for a more detailed explanation as to how MetricsCube can assist you in your routine LTV analysis, be sure to check out the below video guide: