The Monthly Recurring Revenue report provides a general overview of how well your recurring services are doing. As we have explained in the previous article, just by looking at the total MRR value, you can get an idea if things are going in the right direction and plan further strategies for your business.

There is, however, much more to learn from the Monthly Recurring Revenue report once you dig deeper and explore data by distinguishing between different MRR types, applying various filters, and monitoring each event individually. This is why, in MetricsCube, we have a premium section called MRR Breakdown that sheds light on this valuable insight in a significantly more detailed manner.

MRR Growth vs MRR Total

First of all, you need to take into account that there are two Monthly Recurring Revenue variants that MetricsCube shows separately:

- MRR Growth – it presents only the fluctuation of your MRR on a monthly basis, i.e. every change that affects the MRR value. A deeper insight into the possible changes will be offered in the further part of this article.

- MRR Total – it shows a full value of your MRR for each month, that is including the regularly renewed services as well as the amortized MRR which we will discuss in more detail below as well.

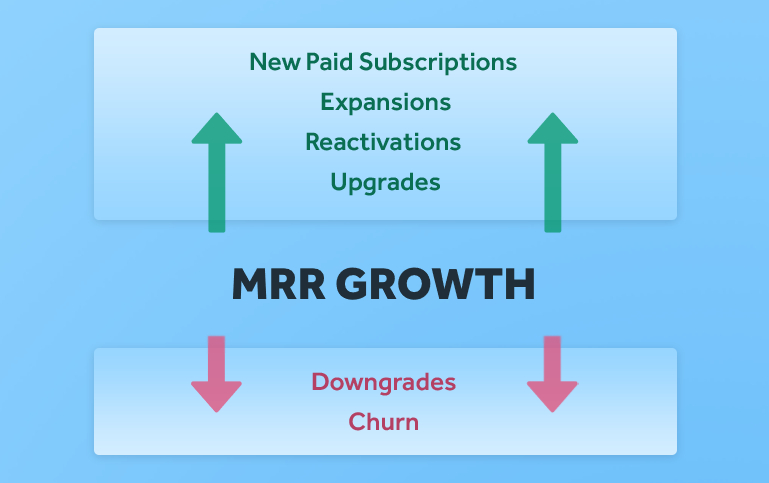

MRR Growth factors

There are certain events in WHMCS that are affecting your Monthly Recurring Revenue – both those which increase its value, and those which result in MRR decrease.

What increases MRR?

- New Paid Subscriptions – presents every new subscription that your client paid for, adding a new recurring income to your MRR. It includes only new purchases from new subscribers.

- Expansions – shows new paid subscriptions from the current subscribers, allowing you to monitor how much of the new Monthly Recurring Revenue your existing customer base generates.

- Reactivations – informs on the MRR value produced by subscriptions that previously churned for some time. For instance, if your customer has decided to use their web hosting again after requesting its cancellation 3 months ago, it will be considered the Reactivation.

- Upgrades – presents MRR related to all types of a price increase in a particular subscription. It may not always represent an actual upgrade in your WHMCS, but, for example, the strategic rise of the service’s recurring price.

What decreases MRR?

- Downgrades – any changes to the Monthly Recurring Revenue of a particular service that make it lower than before. Exactly as for upgrades, it doesn’t necessarily mean an actual downgrade, but e.g. a discounted recurring price for the service.

- Churns – measures how many of your customers cancel their subscriptions each month. This value includes both cancelled services and those not paid on time. You can read more about Churn in our other article.

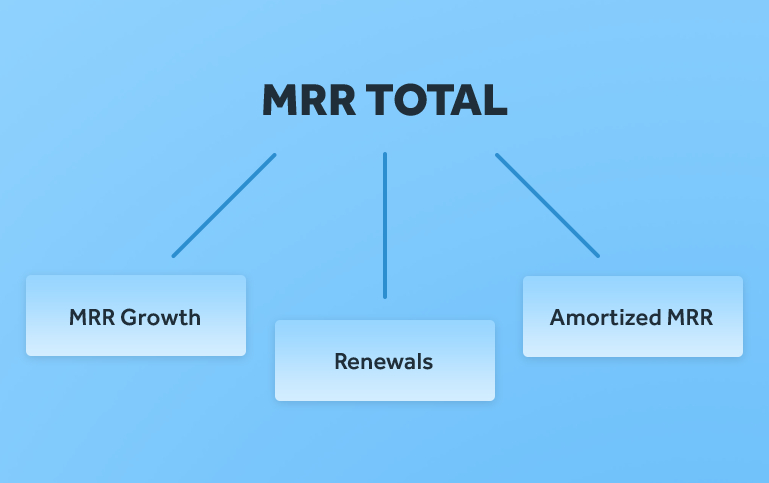

Uncovering the mystery behind MRR Total

We were receiving quite a lot of questions from our customers regarding the calculation of the total amount of Monthly Recurring Revenue, which – before the introduction of MRR Breakdown – was quite enigmatic. The new premium section in MetricsCube gives you immediate access to a much more thorough knowledge on your earnings.

MRR Total includes the MRR Growth (representing the fluctuation) together with the regular renewals and amortized MRR. Renewals are pretty straightforward – customers have renewed the service in a given timeframe so your MRR remains at the same level. Any change to that value is reflected in the MRR Growth report.

What is the Amortized MRR then?

Amortized MRR is the least obvious value, and because of being so, often overlooked by newcomers to MRR analysis. To better explain it, let’s go back to the essence of the Monthly Recurring Revenue report.

As we know already, it measures the amount of predictable revenue to be received on a monthly basis, which is not a problem as long as the monthly services are involved. But what about all other billing cycles? How can MRR take account of an annual recurring service which is renewed only once a year? In any such case, MRR is calculated based on the following formula:

MRR = Annual Recurring Revenue / 12

We can count it as Renewal only once every twelve months, but what’s problematic is that MRR does not go down or up accordingly for the remaining period of 11 months. Amortized MRR has been thought up to plug that particular gap. It shows the MRR value for all the services that were already billed in the previous periods, but still count as MRR in the current period.

Consider the following example:

☞ A customer buys an annual service for $120/year on 1st January 2019, which translates into a New Paid Subscription along with a $10 MRR Growth in the report of January 2019.

☞ The customer renews their subscription exactly one year later, which is listed as a Renewal in January 2020. There is no new MRR Growth reported, its value remains at the level of $10 for the entire renewed period.

☞ In all other months between January 2019 and January 2020, there is $10 Amortized MRR shown for that particular service.

A closer look at MRR Breakdown in MetricsCube

Now that we have presented a quick rundown on some of the key details of MRR Breakdown, we specifically recommend that you watch the below video guide so as to deepen your understanding of how this premium section works, and learn all the tricks to further enhance your business analysis techniques.